Financing

Puppy Financing

Make low monthly payments with zero down on all plans. Get approval within 15 minutes!

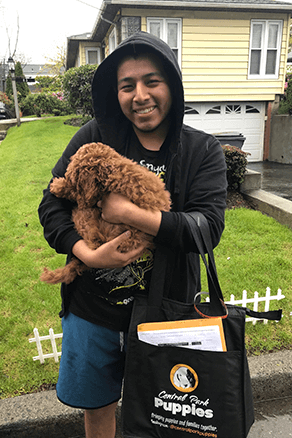

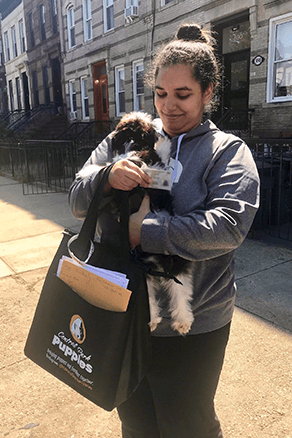

At Central Park Puppies, we understand how much joy a new puppy can bring to your life and your family. We want to make it easier for you to afford your furry friend without paying the full amount up front. With fast approval and flexible payment plans, you can start bringing your dream puppy home today!

Make low monthly payments with zero down on all plans. Get approval within 15 minutes! At Central Park Puppies, we understand how much joy a new puppy can bring to your life and your family. We want to make it easier for you to afford your furry friend without paying the full amount up front. With fast approval and flexible payment plans, you can start bringing your dream puppy home today!

Puppy Financing Options

CORE TEAM

We’re dedicated to excellent service and care.

Everyone at Central Park Puppies is committed to helping you find the perfect puppy. We promise to make your puppy purchase an enjoyable experience and ensure that your puppy is healthy, delivered safely, and right for you.

Julian Perera

Co-Founder & CEO

Ash Perera

Co-Founder & CMO

Christian Langer

Product Development Strategist

Sandrine Kodi

Client Specialist

FAQs about Puppy Financing

How does puppy financing work?

Pet Loans are offered by various financial institutions, credit institutions, and websites. Once a loan application has been approved, the lender will check the details and credit history. Upon submitting your application, the lender will recommend conditions, including a limitation of expenditure.

How do I know if a financing option is a good deal?

It is important to carefully compare financing options and consider the total cost of financing, including any interest and fees. Be sure to read the terms and conditions of any financing offer carefully and ask questions if anything is unclear.

Can I finance a puppy with bad credit?

It may be more challenging to finance a puppy with bad credit, but it is not impossible. Some lenders may be willing to work with you if you have a cosigner with good credit or if you can put down a larger down payment.

What are some red flags when buying a puppy from a breeder?

When purchasing a puppy from a breeder, there are some red flags to be aware of. Be sure to ask for the breeder’s credentials and vet records. Ensure their puppies receive regular veterinary care, vaccinations, and check-ups. Ask questions about their breeding program: how they arrange litters, their process for selecting the best puppies, etc. Also, check to ensure the puppies are socialized and not living in unsanitary conditions. Finally, request proof of necessary paperwork, such as a health certificate or registration papers. If they can’t provide this information, it may be wise to look elsewhere.

What credit score do you need to finance a pet?

Usually, pets are financed with credit scores of around 600. However, requirements differ based on loan institutions. Some banks may require 650, and other lending companies can accept borrowers with scores below 550.

Do dog breeders usually take credit cards?

Yes, many dog breeders do take major credit cards, and is the safest option. However, some breeders will accept other forms of payment (although not recommended due to lack of protection), such as cash, check, Zelle, or even PayPal. It is best to check with the individual breeder to determine their payment options.

Are there any alternatives to financing a puppy?

If financing is not an option, or if you prefer not to finance your puppy, we recommend saving until you’ve collected enough funds to cover the purchase cost plus expenses on caring for your puppy. Remember, there are other costs to take into account when a puppy is under your care, such as food, training, vet expenses, etc. Adopting a puppy from a rescue organization or shelter is another alternative that may be more budget-friendly and can also help save a life.

Are there any requirements for financing a puppy?

Requirements for financing a puppy may vary depending on the lender. Still, generally, you will need to meet specific criteria, such as being at least 18 years old, having a good credit score, and being able to provide proof of income and employment.

, enter your information and

, enter your information and  .

. at Checkout and click

at Checkout and click  to view 6-months to 24-months options.

to view 6-months to 24-months options.